Financial Peace of Mind

~ Sunday, April 9, 2023 Blog Post ~

Financial peace of mind pertains to a state of being where you feel comfortable with your financial situation. It is where you possess a sense of security about your future.

Moreover, financial peace of mind comes from being aware that you have sufficient money to save for your future goals and cover your expenses. This state of being emanates from yourself possessing control over your finances.

You can achieve financial peace of mind by living within your means, creating a budget, and saving for emergencies. Furthermore, you can attain this much-coveted financial state of being by investing for retirement and paying off debt.

Here are some relevant references and insights about how to achieve financial peace of mind:

(2) Four Ways To Achieve Financial Peace Of Mind (From Aureusfinancial.com)

One of the most common stressors that people face is around their finances. Financial stress can keep you up at night, make you ill and negatively affect your mood. Contrary to popular belief, you don’t need to earn a six-figure salary to achieve financial peace of mind. You just need to alter your mindset and make some practical changes to your finances. Here for four ways to achieve financial peace of mind.

1. Change Your Mindset

How you think about money has to precede every other change you make. Shifting your mindset will alter the way you see and spend your money. It will also get you on the right track to getting peace of mind. A person with a negative money-mindset will believe the following:

- Debt is a part of life which cannot be avoided

- Only rich people can afford nice things like cars or vacations

- It’s impossible to get by without the use of credit cards

- It’s impossible to save enough money for retirement

People with this mindset will have more debt than they can handle, with no savings and no plans for retirement. Fortunately, achieving financial freedom is possible, but having a negative mindset will not help you get there. Once your mindset has changed, you will find it easier to manage your finances effectively.

2. Learn To Manage Your Money

Managing your money doesn’t mean that you can’t spend it on anything other than the essentials. It means that you should be aware of what is draining your finances, and what you’re spending it on. When you don’t know what you’re spending money on, you’ll end up wasting it, falling short and accumulating debt.

3. Make A Detailed Budget

Having a detailed budget is vital. With each income you receive, you should make a new budget to spend it correctly. Once you have a plan for every dollar, there shouldn’t be a need for credit cards and other things that accrue debt.

4. Reduce Your Debt

The accumulation of debt is a substantial drag on your finances. Having debt that you don’t deal with will only cause more stress, and it definitely will not provide financial peace of mind. Calculate an amount of money to pay towards your debt every month. This figure should remain constant until the debt has been eliminated, so make it a priority payment that is paid in the beginning, along with other essential expenses.

Invest In Your Future

Another thing that could cause stress in your life is the lack of planning for your future. With your debt paid off, you will have excess money to put towards the future. A good idea would be to put the additional finances into investments that will grow over time. This way, you won’t even have to think about putting money aside or risk spending it frivolously. Also, the money you invest will grow exponentially over the years, until you’re ready to retire comfortably.

When trying to attain financial peace of mind, your mindset is the first thing that has to change. Once you have a positive attitude towards managing your money, you can make detailed budgets and start to chip away at your debt. Think about it — when you achieve financial peace of mind, what could stop you? Don’t hesitate, start making the changes now.

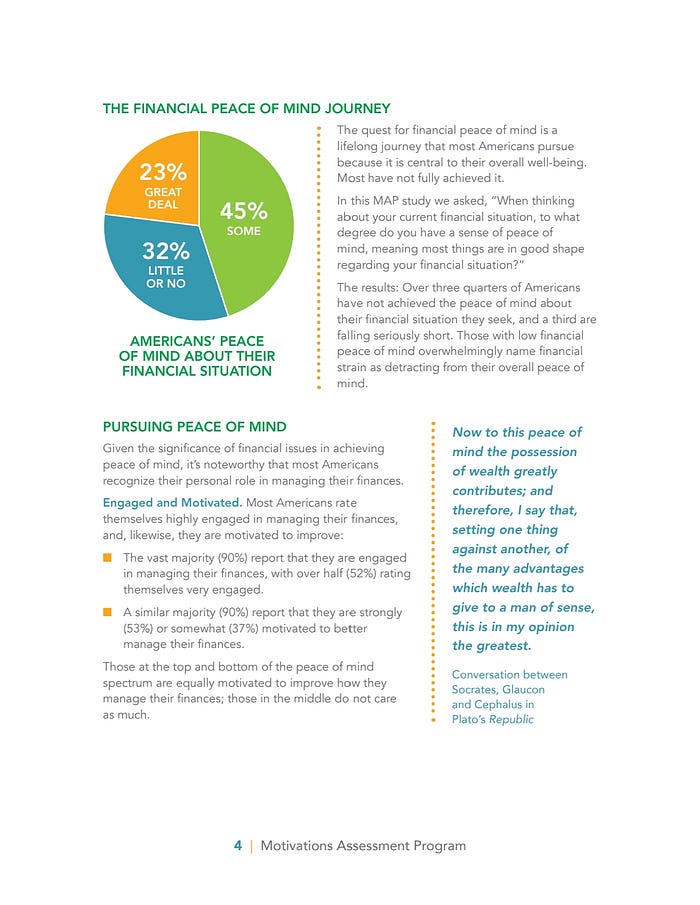

(3) The Quest for (Financial) Peace of Mind (From Artemis Strategy Group)

(5) 4 Smart Moves to Achieve Financial Peace of Mind (From CFinancialFreedom.com)

By Jason Cabler, August 31, 2017

Financial peace of mind is one of the most important things Angie and I have been able to achieve in life. It was a long time coming, but I can tell you that beyond a shadow of a doubt, our financial freedom has had an incredible impact on our lives that goes far beyond money and finances.

In this article, I’ll show you how getting financial peace of mind has changed our lives for the better, as well as some of the most important things you can do to achieve financial independence in your own life.

We Had No Financial Peace of Mind

When we first started this journey years ago, Angie and I were absolutely terrible at communicating about money. Lack of financial unity was causing upheaval in our marriage and making us into stressed out, unhappy people.

When we finally decided we had to do something about it, it took a couple of years for true change to take hold. But once we took the time to learn good financial habits and apply them to our lives, our financial peace of mind has done nothing but increase!

What We Have Accomplished Financially

Since those early days we’ve accomplished some pretty awesome milestones!

We’ve been able to:

- Pay cash for our last five cars.

- Pay cash for Angie’s two completed college degrees at a time when our income was cut in half.

- Totally eliminate money fights from our marriage for over 12 years and counting!

- Pay cash for two more college degrees for my wife and son.

- Use cash to pay for all our vacations.

- Pay cash for our daughter’s wedding.

- Pay cash for a rental house that generates passive cashflow every month.

- Teach our kids by example how to succeed with money.

- Achieve a level of happiness and freedom that would not exist if we were deep in debt and worrying about how to pay the bills.

Anyone Can Achieve Financial Independence

One of the cool things about the level of financial independence we’ve achieved, is that we understand that we’re not special. Over the years of gaining our own financial freedom and teaching others how to do it, we’ve come to realize that financial independence is something anyone can achieve!

How to Achieve Financial Peace of Mind

So what does it take to get the financial peace of mind that so many of us want but only a few actually get?

You don’t have to make a six-figure income or have superhuman powers.

It starts with the willingness to think different, act different, and not worry about what everyone else is doing.

Below you’ll find some of my best tips for achieving financial freedom.

Keep in mind that you shouldn’t try to do all these at once. It takes time if you want to do it right.

Tackle them one or two at a time.

Just remember to stay patient and keep moving forward.

1. Change How You Think

The first step to achieving financial peace of mind is to change your mindset. How you think about money has to precede everything else.

You should understand there is a huge difference between how the average broke person thinks about money, and how people with financial freedom think about money.

Average broke people believe:

- Debt is an inevitable part of life.

- Only rich people can pay cash for things like cars, college, and vacations.

- You can’t get by without credit cards.

- Most people can’t get out of debt.

- It’s necessary to maintain a high credit score.

- It’s impossible to save enough money to retire.

Consequently, average people are in debt up to their eyeballs, have very little saved for retirement, and have zero hope of ever achieving financial independence.

They simply don’t believe financial freedom is possible. Many believe the lies that the system is rigged against them and there is little or nothing they can do to get ahead.

People with financial peace of mind understand:

- That no matter your income, financial freedom is achievable.

- Maintaining a high credit score has nothing to do with financial success.

- Consumer debt is not conducive to financial peace of mind, and should be avoided.

- Saving for retirement is possible, even if you have a low income.

- Cash is king, and when you set up your finances to reflect that, your financial life gets tremendously easier.

You can’t go from being a normal broke person to having financial peace of mind without changing your mind about how money should be used. Here are some of my best posts on how to achieve a better mindset when it comes to money.

2. Learn to Manage Your Money

Another important part of becoming financially free is knowing how to manage your money well. According to a survey I did here on CFF a few months ago, 75% of people are doing an inadequate budget or no budget at all.

That’s terrible!

When you don’t know where your money is going, you end up wasting money, spending more than you make, and living in debt (see the average broke person above).

Financial peace of mind is easier when you can manage all your finances in one place. Personal Capital is the best tool to make it happen! Learn more about Personal Capital here.

3. A Detailed Budget is the Solution

Angie and I have been doing a detailed written budget every single month for a dozen years now. It’s by far the most important thing we do to stay on track financially. It’s the number one tool we used to achieve financial peace of mind.

We discovered long ago that when we have a plan for every dollar, we don’t have to resort to credit cards and other types of debt to run our financial life.

Here’s my Budgeting Page with blog posts and free budgeting printables to get you started.

4. Get Out of Debt

Once you change your mindset and start budgeting, it’s time to start getting out of debt.

Debt is a huge drag on your finances! Servicing the debt on credit cards, car payments, home equity loans, and other debt is costing you thousands of dollars every year!

It’s also costing you peace of mind.

What if, instead of sending loan payments to the banks every month, you could put that money in the bank?

Yep, it can be done!

It’ll take a good plan and some discipline to get the job done. But when you decide that debt no longer has a place in your home, you set yourself up for financial freedom in a huge way!

Follow your get out of debt plan to completion and life will never look the same!

- You’ll pay cash for your cars (and repairs!).

- You won’t have to put Christmas on credit cards and pay it off later.

- Your vacations are completely paid for before you get back home.

- There will be money in the bank for emergencies.

- You will achieve a level of financial peace that most people only dream about!

Read my complete “get out of debt” series of blog posts here to make your customized plan for getting out of debt.

Invest in Your Future

After you have relentlessly tackled your debt, investing in your future is the next key to getting financial peace of mind. Following the previous three steps allows you to fix your finances, get complete control over your money, and have an abundance you never would have achieved by being normal and broke.

Now you can start putting tons of money into investments that will grow exponentially over time!

At this point in your journey, financial peace of mind has arrived!

Here are some of my top articles on investing to help you grow your nest egg:

How to Invest Your Money Wisely- The Basics

Late Start Retirement Investing- 7 Tips to Help You Catch Up

4 Alternate Investments That Don’t Involve the Stock Market

Financial Freedom Gives You Options

Because of your financial position you have so many more options available to live life the way you want to live it.

You become unburdened from the financial obligations that limit your choices and freedom.

You are freed up to have more choices in life such as:

- Leaving a job you don’t like just because it pays the bills.

- Working less and having more free time.

- An increased ability to be generous with your time and money.

- Starting that business you’ve always wanted to try.

- Decreased stress levels and better health.

Financial Peace of Mind is Worth the Journey

Financial peace of mind is not as elusive as most people believe it is. I truly believe most anybody can achieve it.

However, it takes time and effort to bring financial freedom into your life, and most people are just not willing to make the sacrifice.

I will tell you from experience though, that it’s totally worth the journey!

Angie and I haven’t had a money fight in a dozen years, and our financial stress levels are pretty close to zero!

We followed the steps above to gain our financial freedom. I guarantee if you follow them too, your results will be beyond your wildest expectations!

Question: Where are you in your quest for financial peace of mind? What are you struggling with in your journey? Leave a comment on our Facebook page or in the comment section below and tell me about it.

(6) Things To Consider This New Years For Financial Peace Of Mind (From Forbes.com)

Andres Garcia-Amaya is the CEO & Founder of Zoe Financial, a wealth platform that accelerates wealth creation.

In the days leading up to 2023, I received the customary flurry of joyful wishes and holiday messages. What I wasn’t expecting was the number of friends and colleagues who paired the greeting with a crucial question: “Andres, what are some financial do’s and don’ts I should keep in mind for the new year?!”

I get it — a new year feels like the best time to start on the right foot. But for many, this new year is bringing more urgency with it. So, what exactly does “right” mean? From a financial standpoint, “right” is the series of choices that make you feel peace of mind. After working with thousands of clients, I’ve seen that these are the main do’s and don’ts wealthy people use as they prepare for the new year.

Do: Set Clear Goals. Don’t: Limit Yourself.

As cliche as this may sound, start the year by setting clear goals. You’ve heard this before, but I want to propose an ambitious goal-setting scenario. Think of these goals as your lifelong dreams. First, list all the things you have always wanted to achieve and, for whatever reason, have not. As crazy as these goals may sound, write them down. Then, determine if each goal is a must-have or a nice-to-have. Once you have this on paper, you’re at a great starting point to prioritize what you want to accomplish during the new year.

Do: Embrace Your Reality. Don’t: Give In To Lifestyle Inflation.

While an ambitious list of New Year’s resolutions is recommended, a big part of achieving your goals is understanding where you are now. Understand your current situation first. Embrace your financial reality, and be aware of your expenses. An excellent way to avoid unnecessary spending is to ask yourself, “Is this something I really need?” or “Do I want this more than investing in my future or growing my wealth?” Furthermore, as you gain a deeper understanding of your reality, check your emergency fund, calculate the future value of your investments and track your net worth.

Do: Explore Your Opportunities. Don’t: Make Impulsive Decisions.

It is normal to be eager about what’s coming. A new year is an exciting time to make better, wiser decisions.

Before jumping the gun on an investment decision, explore all your options. Depending on your risk tolerance, values and short- and long-term priorities, there might be more than one path you can take to grow your wealth. When investing, focus on time in the market, over timing the market. Impulse investment decisions can yield the opposite of your intended effect.

“Time in the market” means relying on a strategy where you don’t try to guess when the market is at its lowest or highest point, nor do you make impulsive decisions based on where the market goes. Instead, you buy the market knowing that your timing might be off but eventually, the longer you stay in the market, the more likely it’ll pay off.

Do: Choose Someone Trustworthy. Don’t: Disregard The Red Flags.

The wealth management space is particularly tricky to navigate. Not only is there ample jargon that can make it easy for a financial advisor to pull a fast one on you, but advisors are also often notably opaque on fees. When you ask someone to manage your money, you give them great responsibility. Thus, you should work with a professional whose interests are aligned with your own and who rises to the occasion by offering unbiased and transparent advice at all times.

Do: Ask For Help. Don’t: Wait Too Long.

Let’s think of an example: If you set a New Year’s resolution to have healthier habits, you’ll likely make an appointment with a physician to see what steps you should take to meet your goals. The same thing should happen with your financial habits. Often the starting point to growing your wealth this year is getting help from the right financial experts. If you decide to do it, make sure it’s someone with whom you feel comfortable sharing things that you might not even share with your closest family members.

While it’s never too late to ask for financial help from an expert, the sooner, the better. After all, the sooner you start, the sooner you can see results in your wealth.

Ultimately, Find Your Way To Wealth.

The start of 2023 is a chance for you to be mindful of your financial situation and set financial resolutions aimed at increasing your wealth for next year and the future. It’s all about GROWTH: Set your Goals, embrace your Reality, identify your Opportunities, focus on your Wealth, Trust your decisions and find Help from unbiased financial experts. Using these do’s and don’ts could help you start 2023 right.

Forbes Finance Council is an invitation-only organization for executives in successful accounting, financial planning and wealth management firms. Do I qualify?

(7) 7 HABITS TO CULTIVATE FINANCIAL PEACE OF MIND (From Bpi-aia.com.ph)

10 May 2022

Your finances can often become the root of your stress and problems. It’s hard to maintain a positive outlook in life when your bank account is close to zero. However, there are several ways for you to attain a healthy mindset for that financial peace of mind. One of the best ways to ensure that you are stress-free financially is to take the time to prepare yourself.

Being prepared is key to becoming financially secure. While several people have different methods of doing so, they all essentially have basic steps in common. Achieving financial peace of mind requires building simple habits that have compounding positive effects in the long run.

Before we go over these habits, let’s briefly talk about financial peace of mind: what it means and why it should be one of your personal finance goals.

What is Financial Peace of Mind?

The concept of having financial peace of mind is defined by how well you understand how your money impacts your relationships. It is also about how money affects you emotionally and spiritually.

To gain financial peace of mind, you must first find a balance between these aspects and avoid overlooking possible risks. There are several methods of doing this, but you can start with the steps indicated below.

1. Determine your current financial situation

Everyone’s financial situation is different. Before you can balance your finances, you must determine your current financial situation and what causes you to stress over it. Common problems often include not having enough money to cover bills, not saving enough cash after expenses, etc.

2. Make smart management decisions with your debt

Make a list of what you usually spend every month and determine which of these are essential and not. Once you have this list, you can create a balanced budget to stick with to help you pay off any debt and avoid further problems in the future.

3. Be open about financial talk with your partner

Financial problems can affect how your relationships play out. Talk to your partner about each other’s finances and how both of you can manage them wisely. By doing so, you can determine a safe budget that will allow you to have financial peace of mind. Despite the difficulty, the habit will become easier over time and enable you to reach your goals.

4. Build a financial safety net and emergency fund

It would help to have a security net for your finances as early as possible because it takes time to build one. Standard methods include getting life insurance, buying a home, and developing an emergency fund. These savings should last you and your loved ones 3 to 6 months or as needed if you cannot attain regular income anymore.

5. Outline your goals for the future

Setting a plan without a goal can easily cause you to become unmotivated and inconsistent with your finances. Create a realistic goal for yourself, depending on your financial capabilities at the time. This will act as a reminder and motivator for you to gain financial peace of mind.

6. Make payments automatic (auto-debit)

Paying your bills as early as possible eliminates additional stress for you that can accumulate over time. If you have a credit card, consider setting automatic payments to essential factors such as home utilities and phone bills.

However, to do this regularly, you need to establish a safety cushion in your bank account, which may take a bit of time to pile up depending on your financial status.

7. Know where your money is going

Having a financial tracking app can help you easily determine your spending habits. This will help you better understand yourself and attain a sense of control over your money.

Small changes towards bigger impacts

Throughout human history, money has been a source of mixed emotions and problems for many. Because of the uncertainties in life, we cannot fully determine how much we need to keep aside for safety. As a result, we often become stressed and frustrated over situations we cannot control.

Adopting a healthy mindset towards your finances as early as possible is one of the best ways to stay stress-free when it comes to finances. This is because attaining financial peace of mind takes time and effort to achieve.

Despite the ongoing pandemic, you can still start making small steps towards financial peace of mind by making the right investments. Contact us today to find an easy way for you to get insured during these uncertain times.

References:

https://www.amazon.com/Finance-Investing-Financial-Management-Budgeting-ebook/dp/B00Y8UBOOY

https://www.amazon.com/Financial-Peace-Consumers-Taking-Control/dp/B00628V4JA

https://www.aureusfinancial.com.au/financial-peace-of-mind/

https://www.cfinancialfreedom.com/achieve-financial-peace-of-mind/

https://www.statista.com/statistics/713951/definition-of-financial-peace-of-mind-usa/